Maximize Your Rewards: A Guide to Using Capital One Travel Benefits. Traveling can be expensive, but with the right tools and strategies, you can significantly reduce costs while still enjoying the experience. One of the best ways to save money and earn rewards on your travels is by using a credit card that offers generous travel benefits. Capital One Travel, with its extensive range of features, is an excellent option for frequent travelers. In this guide, we’ll explore how you can maximize your rewards and make the most out of your Capital One Travel benefits.

1. Leverage Capital One Travel Portal for Seamless Booking

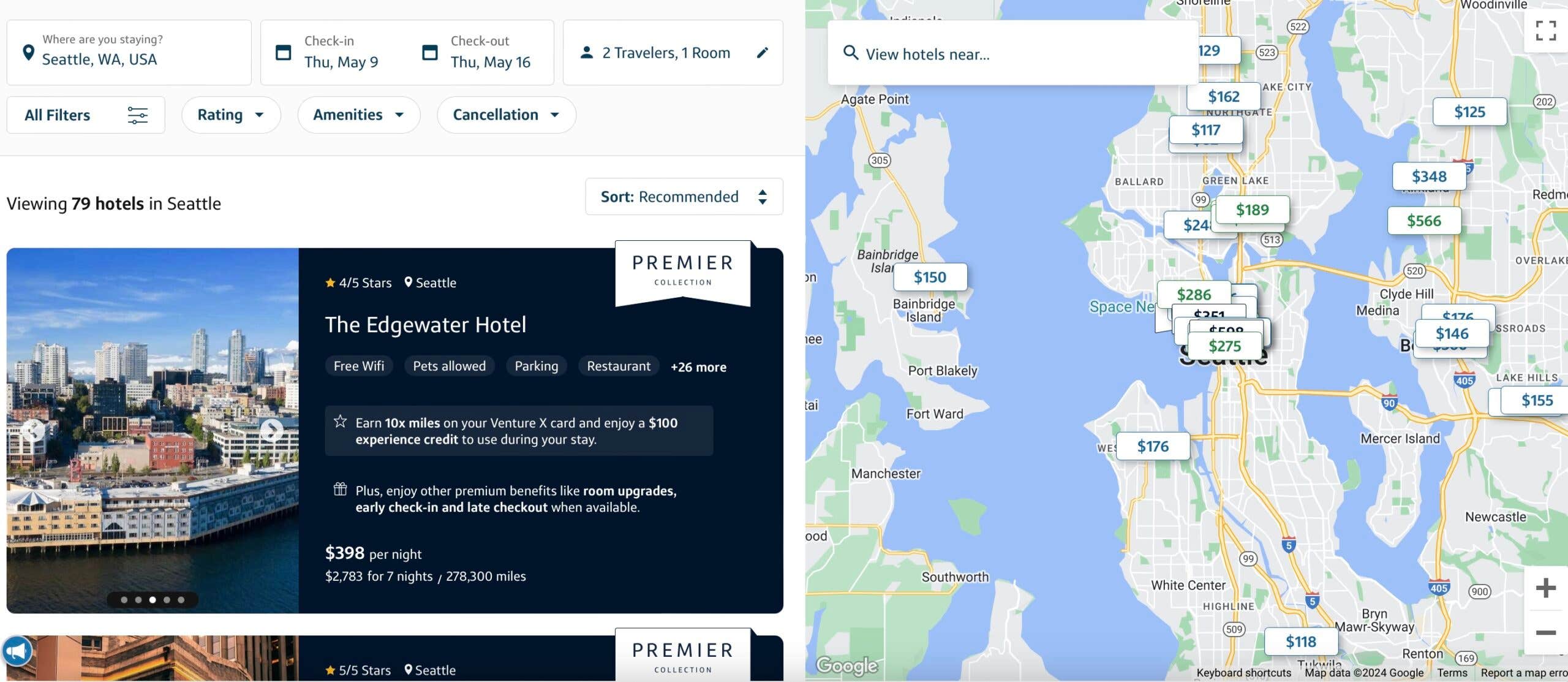

One of the standout features of Capital One Travel benefits is the Capital One Travel portal. This platform allows cardholders to book flights, hotels, car rentals, and vacation packages directly, all while earning additional rewards points.

When you use your Capital One card to book travel through the portal, you typically earn 5 miles per dollar spent on hotels and rental cars, and 2 miles per dollar spent on flights. This means you can rack up a significant number of miles just by making travel arrangements. Moreover, the Capital One Travel portal also offers competitive pricing on travel bookings, often helping you find better deals than booking through third-party sites.

Conclusion: Booking through the Capital One Travel portal is a great way to earn extra rewards points while securing your travel arrangements. Always check the portal first before booking elsewhere.

2. Take Advantage of the Capital One Venture and VentureOne Rewards

Capital One offers two popular travel credit cards, the Venture Rewards and VentureOne Rewards cards, both designed to enhance your travel experience. (Read More: Top 5 Adventure Island Escapes You Must Experience in 2024).

- Capital One Venture Rewards Credit Card: This premium card earns 2 miles per dollar on every purchase. You can redeem these miles for travel expenses, such as flights, hotels, or car rentals. Plus, new cardholders can earn a generous bonus of 75,000 miles after spending $4,000 in the first three months.

- Capital One VentureOne Rewards Credit Card: This no-annual-fee card still earns 1.25 miles per dollar on every purchase, and you can redeem these miles for travel expenses as well. It’s perfect for those who want to earn rewards without paying an annual fee.

Both cards provide added flexibility with how you can use your miles—whether it’s paying for travel through the Capital One Travel portal or transferring your miles to one of Capital One’s airline and hotel partners.

Conclusion: Whether you opt for the Venture or VentureOne card, both offer excellent earning rates on travel purchases, making them ideal for frequent travelers.

3. Use Transfer Partners to Maximize Your Miles

One of the best ways to unlock maximum value from your Capital One miles is by transferring them to one of Capital One’s airline or hotel partners. Capital One has a wide range of transfer partners, including airlines like Aeroplan, British Airways, and JetBlue, as well as hotel chains like Wyndham and Choice Hotels. (Read More: Top Destination Campers of 2024: A Guide to Mobile Luxury).

Transferring your miles to these partners can often result in better redemption options, especially if you plan to book flights or hotel stays. For example, frequent flyer programs like those of British Airways or Aeroplan may offer premium travel experiences, such as business or first-class flights, when you transfer your Capital One miles.

The transfer ratio is typically 1:1, which means every 1,000 Capital One miles will equal 1,000 airline or hotel points. Keep in mind that transfer times can vary, so plan your travel bookings in advance.

Conclusion: Transferring your miles to partner airlines or hotels is a fantastic way to stretch your rewards and access premium travel options.

4. Capital One Travel Benefits for Global Travelers

For those who love to travel internationally, Capital One offers several perks that make your global adventures easier and more affordable. First, most Capital One credit cards offer no foreign transaction fees, meaning you can use your card abroad without worrying about extra charges on every purchase.

Additionally, Capital One offers travel insurance benefits, such as trip cancellation insurance and rental car insurance. These protections can save you money in case of unexpected events or emergencies while traveling. You can also take advantage of the 24-hour travel assistance services, which can provide emergency help during your trip, whether it’s arranging for medical assistance or replacing a lost passport.

Conclusion: Capital One Travel benefits make traveling abroad more convenient and cost-effective, with protections and services that offer peace of mind. (Read More: The Joy of Travel: Exploring the World Beyond).

5. Capital One Lounge Access for Premium Travel Experience

For travelers who value comfort during long layovers, Capital One offers access to its exclusive lounges. The Capital One Lounge network is expanding, providing cardholders with complimentary entry to lounges in major airports across the U.S. If you’re a cardholder of the Capital One Venture X Rewards Credit Card, you get access to the Capital One Lounges, as well as priority access to lounges operated by other partners, like Plaza Premium and Priority Pass.

These lounges offer amenities like comfortable seating, free Wi-Fi, snacks, and beverages, making your airport experience much more pleasant. Lounge access is a great perk for those who often find themselves in transit for extended periods.

Conclusion: Capital One Lounge access elevates your travel experience, giving you a place to relax, recharge, and refresh between flights.

Counclusion article Maximize Your Rewards: A Guide to Using Capital One Travel Benefits

In conclusion, Capital One Travel benefits offer a wealth of opportunities for frequent travelers to earn rewards, enjoy travel perks, and reduce overall expenses. By utilizing the Capital One Travel portal, taking advantage of transfer partners, and making the most of the various travel protections and services available, you can make your travel experience more rewarding. Whether you’re booking your next trip or enjoying the luxury of airport lounges, Capital One has a suite of tools designed to maximize your travel rewards and enhance your journey.